Green Tax Strategy & Compliance

Cost Segregation for Solar: My Secret Weapon for Tax-Free Wealth

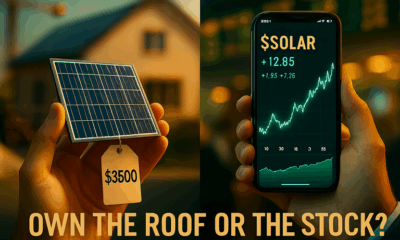

Most investors know about the 30% solar tax credit, but few utilize the «nuclear option» of tax planning: Cost Segregation. In this confession, I reveal how I used this engineering-based study to accelerate the depreciation of my solar assets, creating massive paper losses that wiped out my tax bill legally.

If I am being honest, for the first few years of my real estate investing career, I dreaded tax season. I would look at my rental income, smile at the cash flow, and then cry when I saw how much of it I had to hand over to the government. I thought I was doing everything right by taking the standard depreciation. However, the moment that changed everything was when a mentor asked me, «Why are you depreciating your solar panels over 27.5 years when they become worthless in 20?» That question led me down the rabbit hole of Cost Segregation for Solar, and it completely revolutionized my financial life.

Nobody tells you this, but the tax code is not designed to punish you; it is designed to incentivize you—if you know the rules. Standard accounting treats your rental property (and the solar system attached to it) as one giant block that slowly loses value over nearly three decades. My biggest lesson was that by surgically separating the solar components from the building itself, I could front-load those tax deductions. This strategy turned my solar investments from simple energy-savers into massive tax shelters. In this article, I will walk you through exactly how I did it.

What is Cost Segregation?

To understand Cost Segregation for Solar, you have to stop seeing a building as a «building.» Instead, see it as a collection of assets. The walls and foundation are «Real Property» (depreciated over 27.5 years for residential). But the carpets, the appliances, the specialized lighting, and—crucially—the solar energy system are «Personal Property» (depreciated over 5 years).

A Cost Segregation Study is a formal engineering report that identifies these 5-year assets. By reclassifying my solar array as «5-year property» under the MACRS (Modified Accelerated Cost Recovery System) schedule, I didn’t create more depreciation; I just moved it all to the present day. Instead of taking a tiny $1,000 deduction every year until 2054, I took a massive $20,000 deduction in Year 1. This «Time Value of Money» hack gave me the cash flow immediately to reinvest in more panels.

The «Double Dip»: ITC Meets MACRS

The magic of Cost Segregation for Solar happens when you combine it with the Investment Tax Credit (ITC). In 2026, the ITC allows you to claim 30% of the system cost as a dollar-for-dollar credit against your taxes. But that is just the appetizer. The depreciation is the main course.

Here is the math I used on a $50,000 system:

- ITC: $15,000 direct tax credit (30%).

- Depreciable Basis: $42,500 (Cost minus half the ITC).

- MACRS Deduction: Through cost segregation, I accelerated roughly 85% of that basis into the first five years.

In the first year alone, between the credit and the accelerated depreciation loss, I recovered nearly 45% of the system’s capital cost in tax savings. «Si te soy sincero, sentí que el gobierno estaba pagando la mitad de mi sistema para que yo pudiera generar energía gratis.» It is the most powerful wealth-building tool in the green energy space.

The Engineering Study: Don’t DIY This

One point clave is that you cannot just guess these numbers. The IRS requires a «qualified study.» I hired a specialized firm to visit my properties. They didn’t just look at the receipts; they measured the wiring, the racking, and the inverters. They argued that even the electrical upgrades to the main panel were part of the «solar property» and thus eligible for 5-year depreciation.

The study cost me about $3,000. At first, I balked at the price. But when the report came back showing an additional $35,000 in first-year deductions, the ROI on the study itself was over 1,000%. My advice? Do not try to do Cost Segregation for Solar with TurboTax alone. You need an engineer to defend the numbers if you ever face a Solar Tax Audit.

Real Estate Professional Status (REPS)

Here is the catch that nobody tells you: depreciation is a «passive» loss. Generally, you can only use passive losses to offset passive income (like rent), not active income (like your W-2 job). However, if you qualify as a «Real Estate Professional» (REPS) in the eyes of the IRS, you can use these solar losses to wipe out taxes on your salary.

To qualify, I had to document 750 hours a year of material participation in my real estate business. This was a grind. I logged every hour I spent managing tenants using my Solar CRM for Landlords, supervising installations, and dealing with maintenance. But the reward was sweet. Because I achieved REPS status, the massive depreciation from my Cost Segregation for Solar lowered my overall taxable income bracket, saving me thousands in federal income tax.

The «Short-Term Rental» Loophole

If you have a high-paying job but can’t hit the 750-hour requirement, there is a «backdoor»: the Short-Term Rental (STR) loophole. If the average stay in your property is 7 days or less (like an Airbnb), it is not considered a «rental activity» under Section 469 of the tax code.

I converted one of my solar-powered properties into an Airbnb specifically to utilize this strategy. By materially participating in the management (cleaning, check-ins), I was able to use the Cost Segregation for Solar losses to offset my wife’s W-2 income. It felt like a magic trick, but it is 100% legal if you follow the strict documentation rules. «Mi mayor lección fue que el código tributario favorece a quienes proveen vivienda y energía; solo tienes que estructurar tu negocio para encajar en sus definiciones.»

Impact on ROI and Cash Flow

When you factor in the tax benefits of Cost Segregation for Solar, the Return on Investment (ROI) skyrockets. A system that normally has a 7-year payback period might have a 3-year payback period when you account for the tax savings reinvested.

I treat these tax savings as «phantom income.» I take the money I didn’t send to the IRS and put it immediately into a high-yield savings account reserved for future battery replacements. This creates a self-sustaining cycle where the tax code funds the maintenance of the asset. As discussed in Renewable Insurance Rates, keeping ample cash reserves is also a great way to self-insure against higher deductibles.

Bonus Depreciation in 2026

We must address the elephant in the room: Bonus Depreciation. The Tax Cuts and Jobs Act (TCJA) began phasing out 100% bonus depreciation in 2023. By 2026, unless Congress acts, it may be significantly reduced. However, even without «Bonus,» the 5-year MACRS schedule is still vastly superior to the 27.5-year straight-line method.

Furthermore, solar energy property often enjoys specific «safe harbors» that other real estate assets do not. My tax strategist helped me identify specific state-level incentives that «stacked» on top of the federal depreciation. The landscape changes every year, so having a dynamic strategy is key.

Recapture: The Risk You Must Know

There is no free lunch. If I sell my property three years after taking this massive depreciation, I have to pay «Depreciation Recapture» tax. The IRS effectively says, «We let you take that loss early, but now that you sold it for a profit, you owe us back.» This is taxed at a higher rate (usually 25%).

My Cost Segregation for Solar strategy is a «Buy and Hold» strategy. I never perform a cost seg study on a property I plan to flip. I plan to hold these solar rentals for at least 7-10 years. By then, the time value of the money I saved in Year 1 has far outpaced the future tax bill. Or, better yet, I use a 1031 Exchange to swap the property for a bigger one, deferring the recapture tax indefinitely.

Tips for a Successful Study

- Wait for the PTO: Don’t order the study until the system is «Placed in Service» and interconnected.

- Include the Battery: Ensure the engineer classifies the battery storage as 5-year property (which is standard now under the IRA).

- Bundle Projects: If you did a roof upgrade specifically to support the solar (and can prove it), try to get the engineer to allocate a percentage of the roof to the 5-year bucket.

- Interview the Firm: Ask the cost seg firm if they offer audit protection. If the IRS challenges their numbers, will they show up to defend them?

«El momento que lo cambió todo fue cuando mi contador dejó de decirme ‘no puedes deducir eso’ y empezó a decirme ‘así es como documentamos eso’.» Changing your mindset from defensive to offensive tax planning is the key to wealth.

The Ultimate Green Incentive

Cost Segregation for Solar is the financial heavy artillery of the renewable energy investor. It allows you to legally keep more of your hard-earned money and reinvest it into the planet. While it requires upfront cost and rigorous documentation, the ability to accelerate your ROI makes it a no-brainer for any serious landlord.

Are you ready to stop tipping the IRS and start building your empire? Look at your portfolio. If you have a solar system depreciating over 27.5 years, you are essentially giving the government an interest-free loan. Call an engineer, order the study, and unlock the hidden capital trapped in your walls and on your roof.

Green Tax Strategy & Compliance

1031 Exchanges for Renewable Assets: How I Defer Taxes Indefinitely in 2026

Selling a high-performing solar property comes with a painful price tag: capital gains tax and depreciation recapture. In this advanced financial guide, I reveal how I use Section 1031 of the tax code to swap my green assets for bigger, better ones without paying a dime to the IRS today. It is the ultimate strategy for compounding renewable wealth.

There comes a moment in every real estate investor’s life when they realize that «profit» is a double-edged sword. I remember vividly the day I decided to sell my first solar-powered triplex. I had bought it for $300,000, installed a $40,000 solar array, and aggressively depreciated it using the strategies I discussed in my Cost Segregation guide. The property was now worth $600,000. I was ecstatic—until my CPA sent me the estimated tax bill.

Between the federal capital gains tax, the state tax, the Net Investment Income Tax (NIIT), and the dreaded «Depreciation Recapture,» I was looking at writing a check for nearly $100,000 to the IRS. That was a third of my profit gone. Vaporized.

If I am being honest, I almost canceled the sale. Why work hard to build equity if the government takes such a massive cut the moment you liquidate? But then, my advisor reminded me of the golden rule of real estate wealth: «Swap, don’t sell.» This is the power of 1031 Exchanges for Renewable Assets. By utilizing Section 1031 of the Internal Revenue Code, I didn’t sell my triplex; I «exchanged» it for a larger solar-ready apartment building. The result? I kept 100% of my equity working for me, and I paid $0 in taxes that year.

Nobody tells you this, but the 1031 exchange is the secret engine behind almost every real estate empire. In 2026, with renewable assets appreciating faster than traditional ones, understanding how to maneuver this tax code is essential. In this article, I will explain the mechanics, the risks, and the specific nuances of exchanging green properties.

What is a 1031 Exchange?

At its core, a 1031 exchange allows you to postpone paying tax on a gain if you reinvest the proceeds in a similar property as part of a qualifying «like-kind» exchange. It is not a tax avoidance strategy; it is a tax deferral strategy. You are kicking the can down the road. But if you kick it far enough (until you die), your heirs get a «step-up in basis,» and the tax effectively disappears forever.

For renewable investors, this is critical because of Depreciation Recapture. Remember how we accelerated the depreciation on our solar panels to save money in Year 1? well, when you sell, the IRS wants that money back (taxed at 25%). However, in a 1031 exchange, that recapture tax is also deferred. This allows you to leverage the government’s money to buy your next, bigger deal.

The «Real Property» vs. «Personal Property» Trap

Here is the most complex part of doing 1031 Exchanges for Renewable Assets in 2026. Since the Tax Cuts and Jobs Act of 2017, 1031 exchanges are strictly for Real Property only. You cannot exchange personal property (like machinery or furniture).

This creates a terrifying gray area for solar investors.

- The Conflict: For depreciation purposes (Cost Segregation), we argued that the solar panels were «5-year personal property» to get the fast tax write-off.

- The Exchange: For 1031 purposes, we need the solar panels to be considered «Real Property» (fixtures) so we can exchange them tax-free.

Can you have it both ways? Generally, yes. The IRS regulations for 1031 exchanges define «Real Property» quite broadly. Under state law, solar panels bolted to a roof are typically considered a permanent fixture (Real Property). Therefore, even if you depreciated them fast, they usually qualify for the exchange.

However, my biggest lesson was to ensure the sales contract explicitly lists the solar system as part of the building’s fixtures. If you list the solar panels separately as «equipment» on the Bill of Sale, an auditor might argue they are personal property and trigger a tax event on that portion of the sale. Always consult a Qualified Intermediary (QI) who understands this nuance.

The «Boot»: How to Accidentally Trigger a Tax Bill

In 1031 terminology, «Boot» is any value you receive that is not like-kind property. This is usually cash or debt reduction.

Cash Boot: If I sell my property for $600,000 and decide to pocket $20,000 to buy a new boat, that $20,000 is taxable immediately. To fully defer taxes, you must reinvest all the net proceeds.

Mortgage Boot: This is the one that catches people. If my old property had a $300,000 mortgage and my new property only has a $200,000 mortgage, the IRS sees that $100,000 difference as «debt relief,» which is treated as income. I effectively «made» $100,000 by owing less money. To avoid this, your new solar property must have a mortgage equal to or greater than the old one.

The Timeline: The 45-Day Pressure Cooker

The hardest part of 1031 Exchanges for Renewable Assets is the strict timeline.

- Day 0: You close the sale of your old property. The money goes to the QI (not you).

- Day 45: You must submit a written list of potential replacement properties. This is hard. Finding a good deal in 45 days is stressful.

- Day 180: You must close on the new property.

To manage this stress, I use a «Reverse 1031» strategy whenever possible. This is where I buy the new solar property first (using a bridge loan) and then sell my old one. It is more expensive due to legal fees, but it removes the risk of being homeless and tax-exposed if I can’t find a new deal in 45 days.

Solar-Specific Strategy: The «Green Upgrade» Play

My favorite strategy is the «Green Upgrade.» I sell a fully stabilized, high-performing solar property to a turnkey investor who wants cash flow. I then use the proceeds to buy a «fixer-upper» with no solar, poor insulation, and high utility bills.

Why? Because I can force appreciation. I take the tax-deferred capital, install a massive solar array, implement my Solar-Powered Heat Pump Strategy, and upgrade the Smart Breakers. This instantly lowers the operating costs, increases the NOI, and boosts the property value. Then, I hold it, depreciate the new solar (using Cost Segregation again!), and repeat the cycle in 5-7 years. This is how you ladder your wealth using the tax code and the sun.

Delaware Statutory Trusts (DSTs): The Retirement Move

What if you are tired of being a landlord? What if you want to sell your rental portfolio but don’t want to pay the tax? Enter the Delaware Statutory Trust (DST).

A DST allows you to 1031 exchange your active rental property into a passive «fractional ownership» of a massive institutional asset. In 2026, there are DSTs specifically focused on renewable energy infrastructure—like large-scale solar farms or eco-friendly apartment complexes.

I recently moved a portion of my portfolio into a Solar DST. I no longer manage tenants or fix toilets. I just receive a monthly distribution check. The best part? It still counts as a 1031 exchange, so my taxes are still deferred. «Nadie te cuenta esto, pero los DST son la mejor rampa de salida para los inversores inmobiliarios cansados que quieren mantener sus beneficios fiscales.»

[DESCRIPCIÓN_IMAGEN_CUERPO_2: A visual comparison. Left side: A stressed landlord fixing a solar panel on a roof in the rain. Right side: A relaxed investor sipping coffee while looking at a tablet showing ‘DST Portfolio Growth’. A bridge labeled ‘1031 Exchange’ connects the two sides.] Alt Sugerida: Comparison of active landlord vs. passive DST investor using 1031 exchange.

Opportunity Zones vs. 1031: Which is Better?

You might hear about «Qualified Opportunity Zones» (QOZ). These allow you to defer taxes if you invest capital gains into distressed areas.

The Difference:

- 1031: Defers tax indefinitely. Must reinvest all proceeds (principal + profit). Strict timeline.

- QOZ: Defers tax until 2026 (or later depending on current legislation extensions). Only need to reinvest the profit. More flexible timeline.

For a solar investor, 1031 is usually superior because the deferral is indefinite. However, if I want to take some cash off the table (the principal) and only invest the profit tax-free, QOZ is the way to go. Also, QOZ investments grow tax-free if held for 10 years. I use QOZ for speculative development deals and 1031 for stable rental swaps.

Comparison: Taxable Sale vs. 1031 Exchange

| Scenario | Sale Price | Cost Basis | Capital Gain | Tax (approx 25%) | Investable Cash |

| Taxable Sale | $1,000,000 | $400,000 | $600,000 | **$150,000** | $850,000 |

| 1031 Exchange | $1,000,000 | $400,000 | $600,000 (Deferred) | **$0** | $1,000,000 |

Note: That extra $150,000 of buying power, leveraged at 4:1 with a mortgage, allows me to buy an additional $600,000 worth of property. That is the power of the 1031.

The Infinite Deferral

1031 Exchanges for Renewable Assets are the ultimate tool for preserving the wealth you have created through your green investments. They allow you to move from small residential solar projects to massive commercial arrays without ever stopping to pay a toll to the taxman.

Are you planning to sell a property this year? Stop. Do not list it until you have spoken to a Qualified Intermediary. The difference between selling and exchanging could be hundreds of thousands of dollars. Keep your equity, keep your momentum, and keep upgrading your portfolio until you own the grid.

-

Landlord Renewable Insurance3 semanas ago

Landlord Renewable Insurance3 semanas agoCommunity Solar Insurance Guide: Protecting Shared Assets in 2026

-

Blog3 meses ago

Blog3 meses agoCreate a Calm Living Room on a Budget (Real-World Guide)

-

Blog3 meses ago

Blog3 meses agoentryway organization for a small apartment: Smart, Stylish Hacks That Actually Work

-

Sustainable Real Estate & Rentals3 semanas ago

Sustainable Real Estate & Rentals3 semanas agoMarketing Solar Amenities to Tenants: How to Command Premium Rents in 2026

-

Green Energy1 mes ago

Green Energy1 mes agoDo Solar Panels Property Value Rental Stats Justify the Cost in 2025?

-

Blog3 meses ago

Blog3 meses agoApplying the One In, One Out Rule to Optimize Your Business (Practical Playbook)

-

Blog3 meses ago

Blog3 meses agoThe Ultimate Daily Declutter Routine: 15-Minute Reset for Every Room

-

Blog4 meses ago

Blog4 meses agoThe One-Hour Kitchen Reset: A Weekly Routine for Tiny Kitchens