Green Energy

Do Solar Panels Property Value Rental Stats Justify the Cost in 2025?

I used to think solar was just a fancy toy for eco-warriors. Then I installed a system on my duplex and saw what happened to the appraisal. The results shocked me—and changed my entire investment strategy. Here is the data.

If I’m being completely honest with you, five years ago I laughed at the idea of putting solar energy systems on my investment properties. Solar panels property value rental.

I was a traditional «cash flow» investor. I cared about the basics: a solid roof, working plumbing, and durable flooring that tenants couldn’t destroy. To me, renewable energy felt like a luxury item—something you put on your «forever home» to feel good about the environment, not something you slap on a rental unit where ROI is king.

I remember standing in the driveway of a duplex I had just bought in Austin, staring at the blazing sun beating down on the asphalt shingles, and thinking, «Why would I spend $15,000 on a system when I don’t even pay the electric bill? The tenant pays it. Where is my return?»

That line of thinking was the biggest financial mistake of my early career.

It took a renovation gone wrong, a conversation with a very savvy appraiser, and a deep dive into the solar panels property value rental market data to wake me up. Today, my portfolio is shifting aggressively toward what I call «Green Equity.»

If you are sitting on the fence, wondering if the solar panels property value rental equation actually yields profit or if it is just a money pit, you are exactly where I was. But nobody told me the things I’m about to tell you. Let’s look at the math, the psychology, and the hard reality of solar in the rental game in 2025.

The Appraisal Shock: It’s Not Just «Curb Appeal»

The moment that changed everything happened during a refinance. I needed to pull equity out of a property to fund a new deal. I had installed a modest 5kW system on this house simply because I got a massive tax credit that year, not because I expected it to add massive resale value.

When the appraisal report came back, my jaw hit the floor.

The appraiser had added a specific line item for «Green/Energy Efficient Features.» It wasn’t a guess. It was calculated based on the Net Present Value (NPV) of the energy savings over the life of the system. This was my first introduction to how the solar panels property value rental assessment actually works in the banking world.

In 2025, the game has evolved. Appraisers are no longer looking at solar panels like they look at a swimming pool (which often adds zero value and high liability). They are looking at them like a financial asset that generates predictable yield.

According to data from Zillow and the National Renewable Energy Laboratory (NREL), homes with solar panels sell for approximately 4.1% more than comparable homes without them. On a $400,000 property, that is an instant $16,400 in equity.

Think about that. If the system cost you $15,000 (before tax incentives), and the home value jumps $16,400, you have essentially printed money. And that doesn’t even touch the monthly cash flow benefits yet. The solar panels property value rental correlation is undeniable when you look at the raw sales data in sunny states.

Read more about my top renovation strategies for forcing appreciation here.

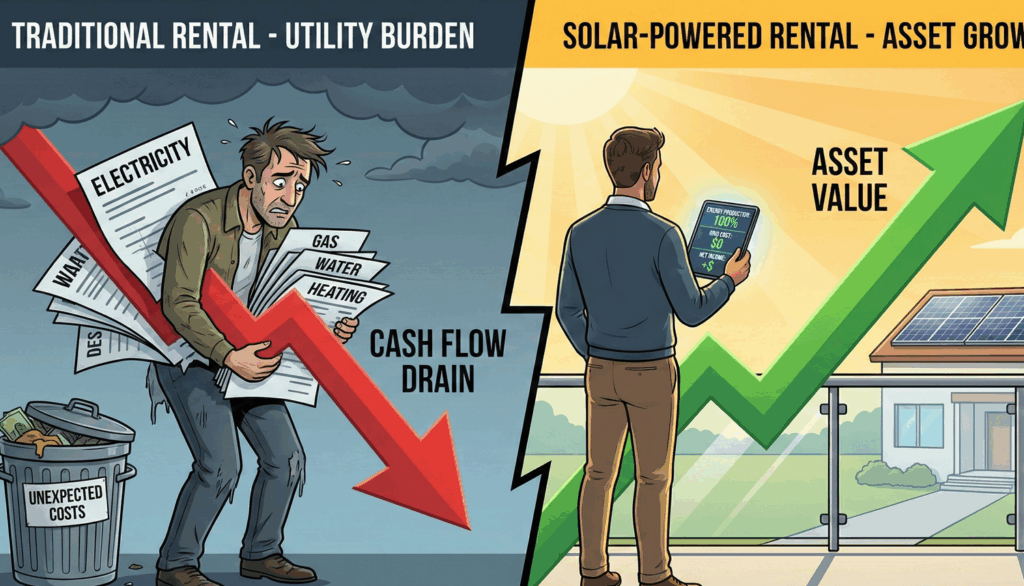

The «All-Bills-Paid» Goldmine Strategy. Solar panels property value rental

This is the secret sauce that most landlords miss. We are conditioned to think: «Landlord pays mortgage, tenant pays utilities.» It’s the safe way. But safe doesn’t get you high margins.

When I installed solar, I switched my rental model on those units. I started marketing them as «Eco-Luxury Living: Utilities Included.»

Here is the psychology behind it:

- The Tenant’s View: They hate volatility. They hate dreading the mailbox in August or January, fearing a $300 electric bill. They will happily pay a premium for a fixed cost.

- The Landlord’s Reality: My solar system produces enough energy to cover 90-100% of the usage.

So, I raised the rent by $200 a month to «cover utilities.» The solar system eliminates the electric bill (costing me maybe $15/month for the grid connection fee). That $200 increase is almost pure profit.

$200 x 12 months = $2,400 additional Net Operating Income (NOI) per year.

In the world of commercial valuation (and large residential portfolios), value is driven by NOI. If you use a standard Cap Rate of 6%, adding $2,400 of annual income increases the property’s value by $40,000. This is the core of the solar panels property value rental strategy: you are forcing appreciation through income, not just bricks.

Equipment Matters: The Heart of the System

If you are going to take this route, especially if you want to implement the «All-Bills-Paid» strategy safely, you cannot rely on cheap, unreliable equipment. You are now a utility provider for your tenant. Reliability is key.

One critical component that determines the efficiency of your setup is the inverter. I have been testing various off-grid and hybrid setups to maximize the solar panels property value rental yield, and one unit has caught my attention for its balance of power and price.

Product Review: Sumry 4000W Off Grid Hybrid Inverter

If you are setting up a system where you might want battery backup (to really sell the «No Blackouts» benefit to tenants), you need a hybrid inverter. The Sumry 4000W is a workhorse that fits perfectly into a mid-sized rental strategy.

Why I chose to review this unit: Unlike standard grid-tie inverters, this is a Hybrid Off-Grid unit. It allows you to manage solar input, battery storage, and grid power simultaneously.

- Pure Sine Wave: This is non-negotiable. Cheap inverters use «modified sine wave» which can damage sensitive electronics like your tenant’s smart TV or computer. The Sumry delivers Pure Sine Wave, ensuring your tenants’ gear is safe.

- Massive MPPT Charger: It comes with a 140A MPPT (Maximum Power Point Tracking) charger. This means it squeezes every drop of efficiency out of your panels, even on cloudy days.

- User Interface: The 6.25-inch LCD display is fantastic. It allows you (or your property manager) to walk into the utility room and see exactly what the solar panels property value rental production looks like in real-time.

The ROI Factor: Usually, hybrid inverters with these specs cost over $600. Currently, this unit is seeing a massive price drop, which helps you recoup your investment months sooner.

👉 Check the current price: Sumry 4000W Off Grid Hybrid Inverter (Approx 59% OFF)

Integrating a robust inverter like the Sumry ensures that your solar panels property value rental system isn’t just a roof ornament, but a fully functional power plant.

The «Leasing» Trap: How to Destroy Your Value

I need to stop here and give you a serious warning. Everything I just said applies ONLY if you own the system.

If there is one thing you take away from this article, let it be this: Do not sign a solar lease or a PPA (Power Purchase Agreement) for a property you intend to sell or rent long-term.

I almost learned this the hard way. A «free solar» salesman tried to convince me to sign a 20-year lease. «Zero down, cheaper power,» he said.

Here is the truth about how leasing affects the solar panels property value rental calculation:

- It becomes a lien on the title (UCC-1 Filing): When you try to sell the house, the buyer has to qualify for their mortgage AND take over your solar lease. This complicates the Debt-to-Income (DTI) ratio for the buyer.

- Buyers hate it: I have seen deals fall apart at the closing table because the buyer didn’t want to inherit a contract with a solar company they don’t know.

- Appraisers ignore it: Leased panels are considered personal property (like a rented sofa), not real estate. They add $0 to your appraisal value.

If you want the equity boost, you must buy the equipment. Cash is king, but financing it with a HELOC or a specific solar loan in your name is also fine, as long as you are the owner of the asset.

Understanding the Tax Benefits (The hidden ROI)

We cannot talk about the solar panels property value rental numbers without talking about taxes. This is where real estate investors have a massive advantage over regular homeowners.

1. The ITC (Investment Tax Credit): In the United States (and many other countries have similar schemes), the federal government effectively pays for 30% of your system. If the system costs $20,000, you get a $6,000 tax credit. This is a dollar-for-dollar reduction in your tax bill, not just a deduction.

2. MACRS Depreciation: This is the heavy hitter. Because your rental property is a business, the solar panels are business equipment. Under the Modified Accelerated Cost Recovery System (MACRS), you can depreciate 85% of the asset’s value. In some years, with «Bonus Depreciation,» you can deduct the entire cost in Year 1.

Consult your CPA, but for high-income earners, the tax savings alone can sometimes cover 50-60% of the total system cost in the first year. This drastically changes the solar panels property value rental return on investment timeline from 10 years down to 3 or 4 years.

Check out my guide on Real Estate Tax Hacks for 2025.

The Tenant of 2025: Why They Choose Green

There is another «soft» value that is harder to measure on a spreadsheet but vital for your sanity: Tenant Quality.

When I started advertising «Green Homes» with solar and EV chargers, the demographic of applicants changed. I stopped getting the people who were scraping by to pay rent. I started getting young professionals, remote workers, and tech-savvy families.

These tenants:

- Stay longer: They appreciate the stable utility costs and the eco-friendly lifestyle. Lower turnover means less vacancy loss.

- Care more about the property: Generally, someone who cares about their carbon footprint also cares about not trashing your carpet.

- Are willing to pay market rate or above: In a competitive market where every landlord has gray vinyl flooring and «stainless steel» appliances, solar is the differentiator. It makes your listing pop off the screen on rental platforms.

The solar panels property value rental dynamic isn’t just about the building; it’s about the quality of the human beings living inside it.

Maintenance Myths that Keep You Poor

«But what about maintenance? What if they break?»

This was my biggest fear. I imagined myself climbing on the roof in a thunderstorm to fix a wire.

Reality check: Solar panels are solid-state electronics. They have no moving parts. They don’t have engines, gears, or belts. In five years, my maintenance cost has been exactly zero dollars.

Rain washes them clean. If you live in a dusty area, maybe you spray them with a hose once a year. Most modern systems come with 25-year warranties on both performance and equipment. Even the inverter I mentioned, the Sumry 4000W, is built to run autonomously.

Comparing solar maintenance to something like HVAC maintenance is a joke. Your air conditioner will break down five times before your solar panels property value rental system has a single issue.

The Train is Leaving the Station

So, do the solar panels property value rental statistics justify the investment?

If you do it right—buy, don’t lease, use quality inverters like the Sumry, and market it correctly—the answer is a resounding yes. It increases the Asset Value (for the bank) and the Perceived Value (for the tenant).

We are moving toward an electrified future. In five or ten years, a rental house without energy efficiency measures will be like a house without central AC today—obsolete and discounting its price to attract tenants.

You have a choice. You can keep paying the utility company forever, renting your electricity just like your tenants rent your house. Or, you can own your power plant, increase your equity, and secure your cash flow against inflation.

For me, that $15k «gamble» turned into the best insurance policy I ever bought. The solar panels property value rental logic is sound, mathematically proven, and ready for you to exploit.

In the next article, I’m going to share the specific calculator I use to determine if a specific roof is worth it, because not every house is a winner. But for now, take a look at your roof. You might be staring at a goldmine.

-

Landlord Renewable Insurance3 semanas ago

Landlord Renewable Insurance3 semanas agoCommunity Solar Insurance Guide: Protecting Shared Assets in 2026

-

Blog3 meses ago

Blog3 meses agoCreate a Calm Living Room on a Budget (Real-World Guide)

-

Blog3 meses ago

Blog3 meses agoentryway organization for a small apartment: Smart, Stylish Hacks That Actually Work

-

Sustainable Real Estate & Rentals3 semanas ago

Sustainable Real Estate & Rentals3 semanas agoMarketing Solar Amenities to Tenants: How to Command Premium Rents in 2026

-

Green Tax Strategy & Compliance3 semanas ago

Green Tax Strategy & Compliance3 semanas agoCost Segregation for Solar: My Secret Weapon for Tax-Free Wealth

-

Blog3 meses ago

Blog3 meses agoApplying the One In, One Out Rule to Optimize Your Business (Practical Playbook)

-

Blog3 meses ago

Blog3 meses agoThe Ultimate Daily Declutter Routine: 15-Minute Reset for Every Room

-

Blog4 meses ago

Blog4 meses agoThe One-Hour Kitchen Reset: A Weekly Routine for Tiny Kitchens